A Guide to Bonus Depreciation and How It Impacts Utility Dump Trailers

Did you know that there are numerous tax incentives that can benefit your business in 2023? One of these tax incentives is bonus depreciation, which can have a significant impact on the purchase and use of utility dump trailers.

Small businesses often rely on utility dump trailers to transport tools, equipment, or inventory to job sites or events. Additionally, motorsports enthusiasts who participate in racing events or own motorcycles also require specialized trailers. Even event planners and individuals who frequently move can benefit from the use of utility dump trailers.

Let’s delve into the details of bonus depreciation and its impact on these trailers.

What is Bonus Depreciation?

Bonus depreciation is a tax incentive that allows businesses to deduct a higher percentage of the cost of qualifying assets in the year they are placed in service. In other words, it incentivizes companies to invest in business equipment by providing accelerated depreciation deductions.

The Impact of Bonus Depreciation on Asset Depreciation

Bonus depreciation has a profound impact on the depreciation of assets for businesses, influencing both financial statements and tax liabilities. By allowing companies to deduct a substantial percentage of eligible assets’ costs in the year of acquisition, bonus depreciation accelerates the depreciation process. This results in a front-loaded tax benefit as opposed to spreading the deduction over the asset’s useful life.

The immediate tax savings can significantly enhance a company’s cash flow, providing additional funds that can be reinvested in the business or used to meet other financial obligations.

However, it’s important for businesses to consider the long-term implications, as the accelerated depreciation may lead to lower deductions in subsequent years and potentially higher taxable income when the assets are eventually sold or disposed of.

While bonus depreciation has a notable impact on a company’s tax position, its influence on financial statements prepared under generally accepted accounting principles (GAAP) is more nuanced. GAAP typically requires the use of the straight-line method for financial reporting purposes, which means that the accelerated depreciation from bonus depreciation does not directly affect the book value of assets on the balance sheet.

However, companies are often required to disclose the differences between tax and book depreciation in their financial statements. This transparency allows stakeholders to understand the adjustments made for tax purposes and the potential impact on future taxable income.

Additionally, the strategic use of bonus depreciation can impact a company’s Return on Assets (ROA). The accelerated reduction in the book value of assets can make ROA appear higher in the earlier years of an asset’s life, reflecting a potentially more efficient use of assets.

However, companies must carefully consider the trade-offs and assess whether the short-term tax advantages align with their overall financial objectives and long-term sustainability.

The Impact of Bonus Depreciation on Utility Dump Trailers

The impact of bonus depreciation on utility dump trailers specifically can be significant for businesses in the construction, landscaping, and waste management industries. Utility dump trailers are essential tools for transporting and unloading materials, such as gravel, sand, debris, or equipment. Bonus depreciation provides these businesses with a valuable tax incentive that can affect their financial position and decision-making.

With bonus depreciation, companies can deduct a substantial percentage of the cost of utility dump trailers in the year of acquisition. This accelerates the depreciation process, allowing businesses to recoup a significant portion of the trailer’s cost immediately.

The immediate tax savings can enhance cash flow, providing companies with additional funds that can be reinvested in their operations or used for other business needs. This is particularly beneficial for businesses with significant capital expenditures, as it can help improve liquidity and support ongoing operations.

The impact of bonus depreciation goes beyond short-term tax benefits. It can influence the decision-making process for businesses looking to invest in or upgrade utility dump trailers. The ability to deduct a substantial portion of the trailer’s cost upfront can make the acquisition more financially attractive.

This, in turn, may encourage businesses to invest in newer, more efficient, or higher-capacity trailers, contributing to increased productivity and competitiveness in their respective industries.

Types of Utility Dump Trailers Eligible for Bonus Depreciation

It’s also important to note the types of utility dump trailers that are eligible. Enclosed utility dump trailers offer additional security and protection for transported items. These trailers are eligible for bonus depreciation if they meet the qualifications set by the IRS.

Another type is open-air utility dump trailers. These are versatile and suitable for various transportation needs. They are also eligible for bonus depreciation if they meet the necessary qualifications.

Investing in a Utility Dump Trailer

Before investing in a utility dump trailer, it’s critical to know the steps to take. Let’s dive into how to be successful with your choice.

Consult a Tax Professional

Before making any investment decisions, it is crucial to consult with a tax professional. They can guide you on the specific tax benefits and deductions related to bonus depreciation and utility dump trailers.

Consider Your Business Needs

When investing in a utility dump trailer, it is essential to consider your specific business needs. Assess the weight capacity, size, and features required. Consider if you need an open or enclosed trailer.

Evaluate Long-Term Benefits

While bonus depreciation offers immediate tax savings, it is important to evaluate the long-term benefits of investing in a utility dump trailer. Consider factors such as durability, maintenance costs, and potential resale value.

Invest in Utility Dump Trailers Today

Bonus depreciation plays a crucial role in influencing the decision to invest in utility dump trailers. By taking advantage of this tax incentive, businesses can increase the asset value of their trailers and enjoy significant tax savings. When considering the purchase of a utility dump trailer, it is important to consult with a tax professional, assess your specific business needs, and evaluate the long-term benefits.

By understanding the impact of bonus depreciation on asset depreciation, you can make an informed decision that benefits both your business and your bottom line.

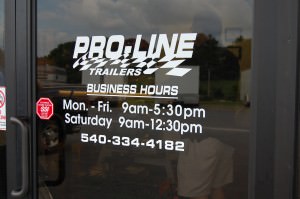

Ready to maximize your tax savings? Contact us now to talk to our knowledgeable and attentive sales staff, or explore our wide range of utility dump trailers.